So now you and your business are up and running, and have been operating for a short while. A bit of time has passed and you are probably curious about how you are progressing financially in your business.

Whether you have an Accountant, Bookkeeper, or perhaps you are doing your own bookwork, it is time to drill down and evaluate a few items on your profit and loss. Understanding this document is paramount in identifying how your business is travelling.

Today we are going to concentrate on an area of your profit and loss – P&L, which you do need to be aware of. Your P&L also has these listed fixed costs expense items that do not really change considerably over any term periods,

Fixed Costs do not go away

Fixed costs (also known as an Overhead) make up the bulk of your monthly expenses. The amount of these fixed costs will vary greatly for each cafe, as it depends on size, location, and fit-out.

These expenses generally stay the same no matter how much business activity is going on each day within your business.

There are a few costs we can isolate as a fixed cost, and some can be debateable as they are a discretionary fixed cost.

The key takeaway here is that fixed costs are an operational cost. These expenses must be paid whether there is income or sales, or even no activity in the business.

Implement controls in your business

An entrepreneurial Nahji Chu started MissChu as a catering business in 2007 before expanding it to retail tuckshops in Sydney, Melbourne, and London. Towards the end of 2014 Misschu had entered voluntary administration.

The appointed administrators with KordaMentha Restructuring, have said it appeared that the financial pressures of MissChu have been caused by the lack of controls over fixed costs in the business, the expansion of the retail tuckshops through trading and the closure of the Opera House premises without notice.

So, what can you as a small business owner, learn from this unfortunate situation that happened to MissChu. Look at your profit and loss, and endeavour to identify these fixed costs, and categorise their importance.

Let us list a few of them to see where they sit.

- Loan Repayments for your business

- Lease Payments

- Staff Salaries and full time Staff

- Insurance Premiums

- Licenses

- Utilities – Power

It is important to know what percentage is your labour to your income, and what percentage is your rent to your income.

Which other expenses can be identified that do not fluctuate with the change in production levels or sales volume?

Understand your percentage to income

I guess the best way to look at these expenses, is that they are the fixed costs associated with doing business. How are we able to alter the effect of fixed costs on our business.

Well, the simple answer is to grow your sales or increase your revenue. As your fixed costs are literally fixed, growing the revenue reduces the impact they have on your profitability.

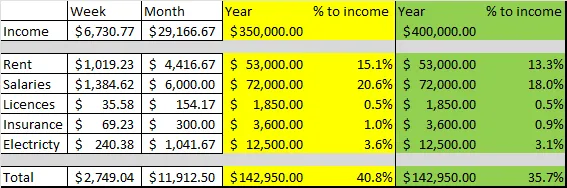

For example, the table below shows the fixed cost percentage for a turnover of $350,000.00 per year.

Look at the impact of growing your revenue an additional $50,000.00. Note how the percentages of your fixed costs drop.

How do you remain ahead of these P&L expense items that are categorised as fixed costs?

Review your operational activities

Expanding operational hours can also lessen the fixed cost impact. The first cafe we owned, was a kiosk style, located in a suburban shopping centre. The previous owners had not been trading on a Sunday, citing that it was a loss to open. It was something we reviewed then implemented within the first month we took over the business. Admittedly the revenue was averagely 52% less than the other six trading days. However, that Sunday trading experienced the same growth as the remainder of the whole business over time.

You could also, as a cafe, investigate renting your leased premises to another food operator outside your set working hours. This could be to a Restaurant business, Night food/takeaway operator, catering business, or simply as a ghost kitchen.

How do you remain ahead of your business operations with its fixed costs?

Well, the simple answer is to grow your sales or increase your revenue. These fixed costs will not go away for as long as you own the business so be aware of them and manage your business to stay on a growth path.

As your fixed costs are literally fixed, growing the revenue reduces the impact they have on your profit. There are also discretionary fixed costs, which are fixed, but can be adjusted, like advertising, subscriptions etc.

If you are in a lull and striving to improve perhaps you could consider negotiating to lower your rent payment for a period to help you out of some stress. With the landlord accepting you as a tenant initially it would be in their best interests to keep you operating rather than have a vacant shop.

A higher concentration of customers is another alternative. However, there is such a large area to cover on that topic and would be best to leave to discuss another time.

Your personal life has fixed costs too

I guess in review you can relate fixed costs to those in your own personal life in order to get a full understanding.

Regardless whether your single or have a family, your personal fixed costs would be your rent or your mortgage, electricity, healthcare, insurance, car or other loan repayments. Most of your other expenses are variable. In this situation, if things were tight financially you may need to look for a second a job (increase revenue).

Same with your cafe, the higher your fixed costs are the harder it is to remain profitable for the long term without growing revenue.

Increasing operational hours could be achieved by looking at additional opening opportunities. If your opening hours are from 7am to 3pm, Monday to Friday near a business centre, try opening an extra day. Or even just open an hour earlier whilst you are setting up. That opening an hour earlier could be an extra $100 per week to start with.

Perhaps you could consider putting together cooking classes in the evenings. Catering for your customers dinners where they can pick up on the way home. We used to make salads that people would collect before we closed. They would go home, cook a piece of protein and add the salad, and wallah, dinner was done.

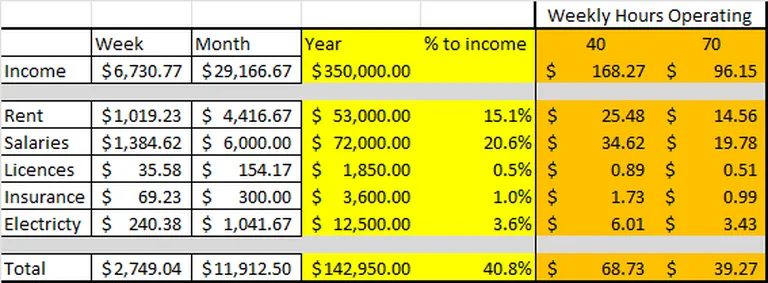

Fixed costs can also be lowered as an expense percentage by the number of hours you operate each day or week, whether you are open for 40 hours per week or 70 hours per week. (Note that there may be additional variable costs on casual labour and electricity.)

Become aware of your fixed costs.

Grab tour latest P&L and go through it with a highlighter, identifying what you classify as a fixed cost.

Remember, a fixed cost does not increase or decrease in amount over a period (with the exception of annual CPI increases.) Whether the level of items sold by the business increases or decreases, they remain then same.

Now you have identified them all, write those bad boys down, along with the cost and percentages. I would use a 6×4 card, or business diary (if you do not have one – get one!).

Looking at your newly created list, identify the items that make up 80% of the total expenses, and that should be two or three expense items. Rent, Wages, Electricity. The Pareto Principle (also known as the 80/20 rule) is a phenomenon. In this instance it shows that 80% of your dollars spent on fixed costs come from 20% of your fixed cost items. This is where you need to focus your efforts.

In Summary

To recall them at anytime these fixed costs you have identified, should be committed to memory. You should be able to recall both your monthly fixed costs, and percentages.

Finally, if you are approached by another food operator about sub-letting your kitchen, you now know a starting hourly rate to charge, to cover your operational fixed costs.

If you have a problem with your fixed costs, or any issues at all concerning your business operations, reach out and send me an email.